Will vs. Trust: Which One is Right for You?

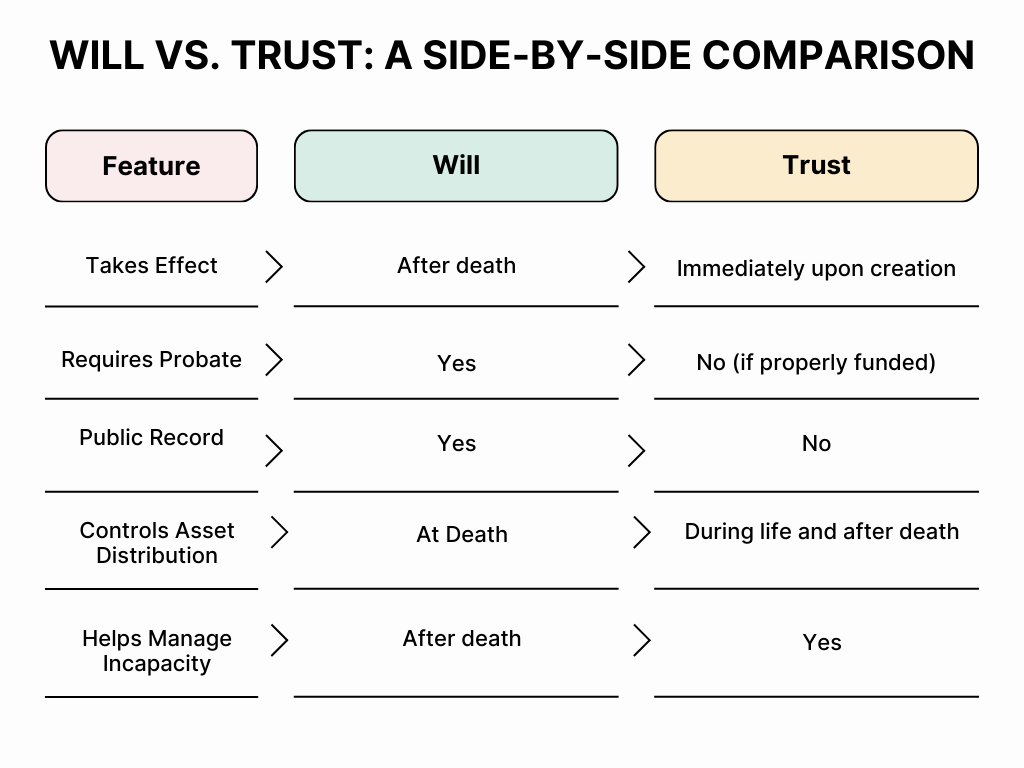

When it comes to estate planning, one of the most common questions people ask is: Should I have a will, a trust, or both? The answer depends on your unique situation, your goals, and the level of control you want over how your assets are handled.

Understanding the differences between wills and trusts is a crucial step in creating an estate plan that truly protects your loved ones and honors your wishes.

The Basics: What Is a Will?

A will is a legal document that outlines how you want your assets distributed after your death. It can also name a guardian for minor children and specify other final wishes, such as funeral arrangements.

A will only takes effect after you pass away, and it must go through a legal process called probate. During probate, the court validates the will, pays off any debts, and oversees the distribution of your estate.

Key Benefits of a Will:

- Simple and cost-effective to create

- Names guardians for minor children

- Clearly outlines your distribution wishes

- Can be updated easily as life changes

However, because a will must go through probate, the process can be time-consuming, public, and expensive—often delaying the distribution of your assets and opening the door to potential disputes.

What Is a Trust?

A trust is a legal arrangement that holds and manages assets on behalf of your beneficiaries. When you create a trust, you transfer ownership of your assets into the trust and appoint a trustee(which can be you, another person, or a professional institution) to manage those assets according to your instructions.

Unlike a will, a revocable living trust becomes effective as soon as it’s created and can help you manage your assets during your lifetime—including in the event of illness or incapacity—and seamlessly transfer them upon your death without going through probate.

Key Benefits of a Trust:

- Avoids probate, saving time and money

- Keeps your affairs private

- Offers

greater control over when and how beneficiaries receive assets

- Can provide

protection for minor children, special needs family members, or beneficiaries who are not financially responsible

- Useful in planning for

incapacity

Trusts do require more upfront work and legal guidance to set up properly, but the long-term benefits often outweigh the initial cost and effort.

Which One Do You Need?

In many cases, you may benefit from having both a will and a trust. Here’s how to think about it:

A Will may be right for you if:

- You have a straightforward estate

- You don’t mind your estate going through probate

- You want to name guardians for your minor children

- You need a cost-effective starting point for your estate plan

A Trust may be right for you if:

- You want to avoid probate and reduce court involvement

- You have property in multiple states (which could require multiple probates)

- You want to keep your affairs private

- You have a blended family or complex distribution wishes

- You’re concerned about incapacity and want a plan in place for managing your affairs

Ultimately, the right choice depends on your goals. At The Edwards Law Firm, we take the time to understand your unique circumstances and help you design an estate plan that gives you peace of mind now and security for your family in the future.

Common Misconceptions

“I only need one or the other.”

In reality, most people need

both. A trust doesn't replace the need for a will—especially if you have minor children or want to name an executor for your estate. A will can also serve as a “pour-over” document to transfer any remaining assets into your trust after death.

“Trusts are only for the wealthy.”

This is one of the biggest myths in estate planning. Trusts are about control and protection—not just wealth. They’re an effective tool for anyone who wants to simplify the transfer of their assets and protect their loved ones.

Let Us Help You Decide

At The Edwards Law Firm, we’re here to guide you through every step of the estate planning process. Whether a will, a trust, or a combination of both is right for you, we’ll help you make informed decisions with confidence.

Our services include:

- Customized wills and trusts

- Powers of attorney and healthcare directives

- Beneficiary review and coordination

- Trust funding guidance

- Ongoing support and updates as your life changes

Take Control of Your Legacy

Estate planning isn’t just about preparing for the end—it’s about taking control of your future and ensuring your loved ones are taken care of. Don’t wait for a crisis to start planning.

Call us today at 540-315-4099 to schedule a personalized consultation.

Let The Edwards Law Firm be your trusted partner in protecting what matters most.